Chapter 7 – Diffusing Change in Organizations

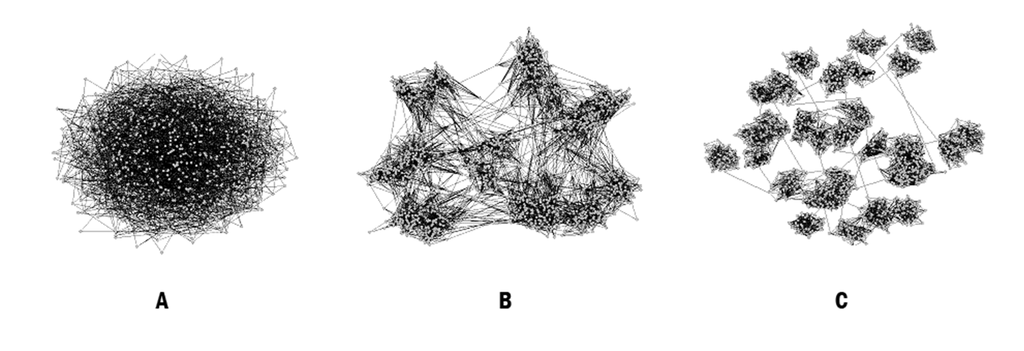

To explore the implications of brokerage ties in organizational networks for the diffusion of “complex” innovations (i.e., requiring coordination between several people), I constructed a model of organizational networks with varying degrees of brokerage. In the simulations below, I show how I used this model to study which conditions were most favorable for the diffusion of innovative practices through organizational networks with structural holes. Figure 7.4 shows three networks along the continuum of structural holes. The network in panel A has no structural holes. It is a random topology in which every node has equal access to the entire network. There are no groups for bridges to form between, so brokerage opportunities are minimized. At the other extreme, panel C shows a network with abundant brokerage opportunities. There are lots of structural holes and only a few brokers who span them. Each broker is in a unique position to transmit information between groups and, in turn, to reap the rewards of structural advantage.

Figure 7.4: Networks with Different Levels of Brokerage

To see how effective each of these organizational networks is for the diffusion of a novel business practice, I ran computational experiments on each one using a “minimally complex” innovation. An innovation with minimal complexity has a threshold of two, such that individuals need to receive confirmation from two colleagues in order to be convinced to adopt.

I began by seeding the innovation into a single neighborhood in each network (that is, approximately 1% of the population in each case) and observing the extent of integration on the behavior that followed.

(A) The Low Brokerage Network

In the low-brokerage network (panel A), the results resembled the random seeding experiments described in chapter 6. In this case, however, instead of seeding randomly all over the network, all the seeds were in the same neighborhood. However, because the network was random, none of the seeds shared neighbors in common, so they could not provide their neighbors with any confirmatory support to coordinate on their adoption of the innovation. This lack of support prevented the innovation from spreading beyond the initial 1% of the organization that was seeded.

(B) Goldilocks Network with ‘Wide Bridges’

In the “goldilocks” network between the two extremes (panel B), the innovation reached over 95% of the population. When the innovation began to spread in this network, clustering within the seed neighborhood allowed rapid coordination on the innovation within the seed group. From there, wide bridges across clusters then carried the innovation to neighboring groups. These cross-cutting ties ensured that the innovation reached each new group while accompanied by reinforcing signals from several peer adopters, allowing it to spread from group to group, across the network.

(C) The High Brokerage Network

In the high-brokerage network (panel C), the innovation quickly reached everyone within the initial seed cluster, but it did not spread beyond that. The bridges across the clusters were long ties and therefore too narrow to provide the reinforcement required to spread the new practice. Consequently, the innovation only reached individuals within the original seed cluster (5% of the population).

Unexpectedly, the results showed an inverted U-shaped effect of network structure on diffusion. The networks that were the farthest away from each other in terms of brokerage potential—that is, the one with no brokerage (panel A) and with high brokerage (panel C)—both performed the same. In both cases, integration of the behavior failed. The main lesson from this study of complexity in organizational networks is that the successful transfer of complex innovations typically requires wide bridges to broker the transmission of influence and expertise across organizational boundaries.